Financial Statement

Financial Statement

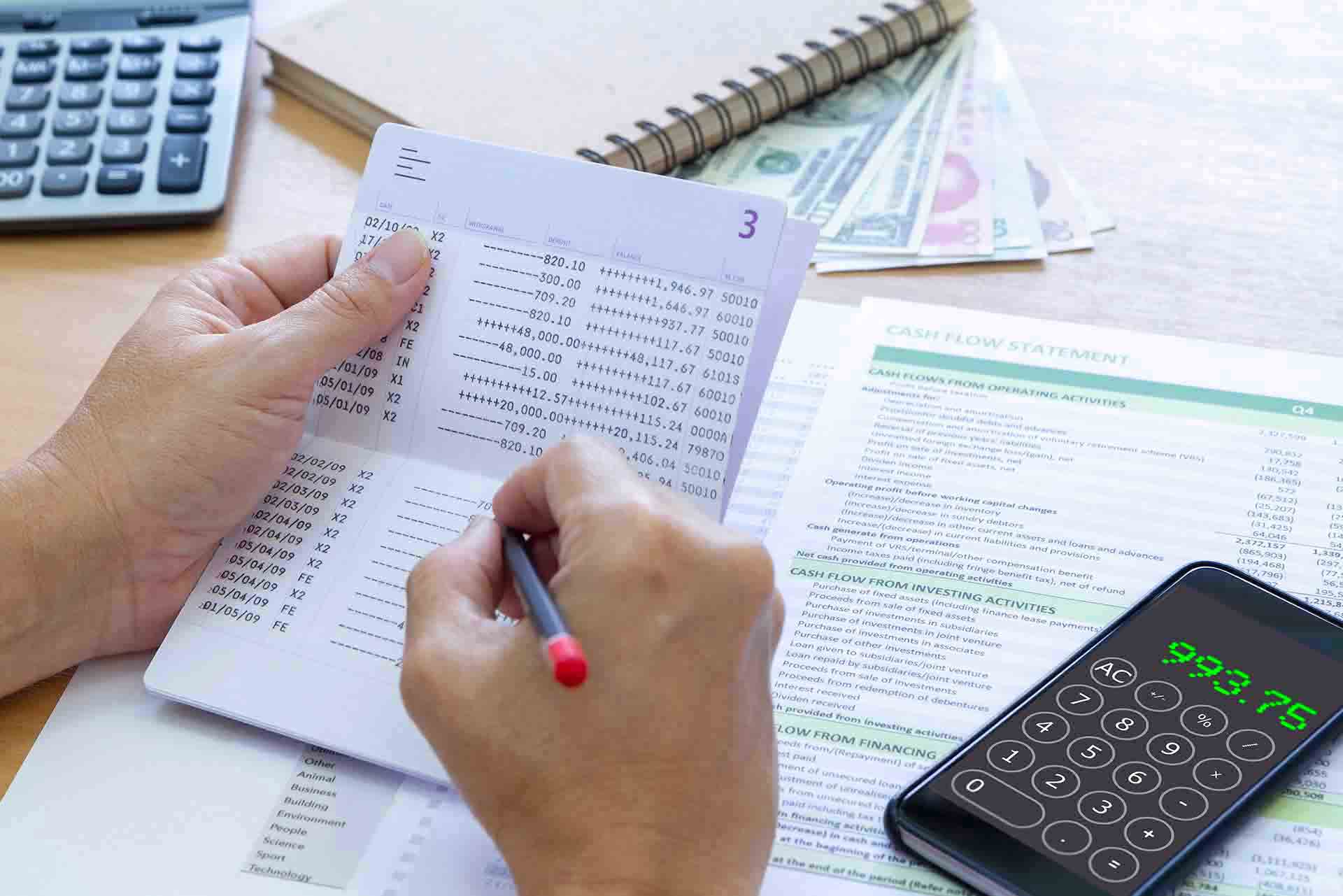

A complete set of financial statements includes the income statement, balance sheet, statement of cash flows, footnotes, and the accountants opinion. Unless the statements are prepared by a CPA, the opinion letter and footnotes generally are omitted and most small companies also eliminate the statement of cash flows.

Financial statements are prepared on either a cash or accrual basis. A cash basis financial statement reports only the money received and spent. An accrual basis financial statement reports all sales billed and not received and all expenses incurred but not paid. The financial and income tax reports can differ, as different rules exist for each.

The descriptions below provide some additional information about each component of financial statements. Many variations in financial statement presentation exist, depending on whether the accounting method is cash or accrual, the type of entity (corporation, partnership, sole proprietorship, etc.), and other factors. The explanations below are general in nature and do not explain all these variations.

Income Statement

Also called a p&l or profit and loss statement, the income statement reports the income and expenses of the business for a given time period of time. The bottom line usually is the net profit after taxes for the period reported.

Revenue or income is shown at the beginning of the statement, followed by any costs that specifically are related to sales or revenue. The difference between sales and cost of sales is called gross profit. Additional expenses are shown as a reduction of gross profit. Taxes and miscellaneous items of income and expense may be shown separately.

Balance Sheet

Also called the statement of assets, liabilities and owners equity, the balance sheet is a snapshot of the assets, liabilities. and equity of the business on a specific date the balance sheet date.

The assets of an entity are the amount of cash, inventory, equipment, and other assets used to generate the companys profit or loss.

The liabilities identify what the company owes to various creditors. The liabilities may include trade accounts payable (unpaid bills), credit card debts, payroll tax deposits, bank loans, or money due to the owners. Liabilities may be identified as either short-term or long-term. Short-term debt is the amount that will be repaid within the next year from the balance sheet date. The long-term debt is the amount that will be repaid in future years or over a time greater than one year.

The third section of the balance sheet is the equity section. It includes the amounts the owners of the entity have paid for common stock and contributed capital, and the total of all profits for the current year and all years since the entity began this usually is called retained earnings.

The balance sheet is used to calculate many ratios that measure the entitys financial health such as the number of days it takes to collect outstanding accounts receivable, the ratio of assets and liabilities, and many other financial statement ratios.

Statement of Cash Flows

The statement of cash flows identifies how cash came into the entity and how this cash was used. It is the only report that ties the income statement and balance sheet together, as information from both is used in this report.

his report explains the changes in a companys cash position between two balance sheet dates. The indirect method is the most common form of cash flow presentation. It starts with the current income or loss, then shows adjustments, such as depreciation, that are not the result of cash transactions. The statement will show other sources or uses of cash such as borrowing or repaying loans, capital contributed by the owner, and sales or purchases of equipment.

Footnotes

Footnotes usually are omitted in financial statements of small businesses, but they are required for reviewed and audited financial statements and sometimes are included with year-end compilations.

The footnotes provide detailed information about the entity’s loans, leasing commitments, accounting policies, and other required information as defined by the American Institute of Certified Public Accountants (AICPA). The AICPA is the organization that defines the rules and procedures used in issuing standard accounting reports.

Opinion

Also called the accountant report, the opinion letter usually is the first page of any financial report package prepared by a CPA. The letter states the type of report being issued and whether material modifications are required for the report to conform with generally accepted accounting principles (GAAP). The three types of financial statements are compilation, review, and audit.

All opinions tell the reader the information represents the entity management. Thus, the purpose of the report is not to detect fraud, but rather to follow the guidelines issued by the AICPA for the opinion or confidence level required

A compilation takes the accounting information provided by the company and presents the information in the form of financial statements. The compilation report tells the reader if management has omitted footnotes, or if the reader should know other information, such as a lack of independence. It provides the least amount of assurance that the financial statements are free from material misstatements, but is the most cost-effective for management. The financial statement report may need to be changed to a review or audit if required by a bank or other third-party user of the financial statements.

The review takes the accounting information of the business and presents it in the form of financial statements with the required footnotes and disclosures. Some inquiries of management and limited analytical procedures are applied. A review report contains the same information as an audited report, but is less costly than an audit because many audit procedures are not required.

An audit report is in the same format as a review. To provide an audited opinion, the CPA must test the integrity of the entity internal control systems and perform additional procedures to determine whether the financial statements are free from material misstatements. Audit procedures include confirmation of data from outside sources such as financial institutions, customers, vendors, and other sources involved with the entity. Full footnote disclosure is required and the CPA issues an opinion on the financial statements, which must be presented according to generally accepted accounting procedures (GAAP).